An organized and stable bookkeeping system can lead to a concrete foundation of business growth and success. By keeping your company’s financial records updated and accessible, you will not only save your time but also avoids unnecessary expenses. You will also enjoy a better and quality back office performance in the long run.

Below are the top essential bookkeeping tips that will help your business to stay organized while you run your company towards success.

- Utilize Separate Bank Accounts

Often, you will see business owners using both personal and business credit cards for company expenses. When you use two different accounts for finances, the risk of generating tax and liability concerns for both of you and the business will increase.

Creating and utilizing separate bank account for personal use and company funds will not only assist you to avoid potential headaches of unwanted expense at the year-end, but you will also gain benefits from:

- Accurate tax deductions for joint expenses such as vehicles and cellphones

- Enhanced financial forecasting, budgeting, and business planning

- Improved positioning in terms of business loans, investor funding, and supplier credit.

Separating your business and personal bank account means you will less like to create unwanted attention and expenses in the form of tax audits.

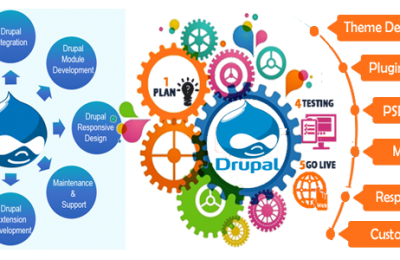

- Make Use of Digital Tools

When talking about organizing small business bookkeeping, you can’t find any excellent line-up of helpers compared to today’s modern digital application, software, and automation.

- Third-Party Application: Ditching manual bookkeeping in exchange for online accounting can provide your business access to a more integrated, and time-saving apps for your financial records and documents. Digital tools will not only make bookkeeping tasks less complicated and time-consuming, but it will also lessen the need for manual data entry, which can lead to fewer transcription errors

- Business Management Programs: There’s no better way to manage and organize your business’ enterprise compared with specialized industry management system or software. Whether you run a small business or corporation, there’s a dedicated management program to assist you in managing your company’s inventory, monitor your sales more efficiently, and tracking your business production

- Automated Electronic Payments: Often, it is not about maintaining better control over your company’s money can make a massive difference in terms of business growth. If you are not aware of it, consider these:

- Streamlining your account receivable by accepting payments via e-transfer like PayPal

- Signing up for email alerts or SMS that will send you a notification to inform you when a credit card or utility bills are ready

- Creating an automated payment to deal with fees like recurring expenses.

Making the most out of your digital assistants will not only assist you in manage and keep your cash flow for the better, but it can also lessen the fees linked with missed or late payments.

- Be Updated With Your Business

The most and most prominent advantage of an organized and well-established bookkeeping system maybe the fact that it is a greater way to stay financially updated about your company. The more updated you are, the more informed and appropriate your decisions will be.

Creating an effort to check and monitor your business accounting statements and transactions regularly will assist you in establishing a successful path towards your business’ success and growth.