Operational Excellence In The Phygital Banking Era: Highlights From A CBA Live 2025 Session

Phygital banking (integrating physical branches with digital tools) is no longer a niche innovation.

At CBA Live 2025, leaders from Capital One, Truist, WesBanco, and Zions shared how the shift to phygital banking redefines the frontline experience. From universal bankers supporting omnichannel journeys to branch teams offering advisory-level service, the frontline function is being elevated (and challenged!) in real time.

The insights below draw from the CBA Live 2025 session on the shift to phygital banking and echo the workforce transformation trends Pathstream supports across large, customer-facing organizations. Read on to learn what it takes to:

- Build human adaptability

- Support growth-ready mindsets

- Deliver hyperlocal customer experiences

- Retain top frontline talent

Phygital Banking Requires Human Adaptability, Not Just Tech Upgrades

According to McKinsey, global banking technology spending is growing by 9%, driven in part by investments in AI-powered assistants and integrated CRM platforms. However, customers are adopting digital banking even faster than employees. That shift pushes frontline roles beyond basic transactions into more complex, cross-channel problem-solving.

Frontline employees are saying, ‘I’m excited about digital — but are you going to close my branch?’” one leader shared at CBA Live.

In response to that uncertainty, session speakers emphasized the importance of equipping teams with skills like:

- Omnichannel fluency to guide customers across branch, phone, and digital touchpoints.

- Service agility to pivot between quick transactions and in-depth advisory conversations.

- Confidence with digital tools, including troubleshooting and customer guidance.

- Real-time decision-making skills, especially in sensitive scenarios.

- Customer-first thinking tied to their roles in the broader banking journey.

- Consultative selling capabilities to personalize conversations and move beyond transactions.

- Modern communication techniques quickly build trust and simplify complex topics across any channel.

Upskilling Is The Engine Behind Phygital Banking At Scale

Training alone isn't enough to prepare the frontline team as the teller-to-universal-banker pathway expands into more consultative, cross-functional roles. "It's not just about chasing the next promotion," one CBA Live speaker noted.

Employees thrive when they're supported in strengthening current skills, gaining confidence in new skills, and developing a growth mindset. That’s why forward-looking banks are exploring solutions like Pathstream — career-building programs that go beyond job-specific training to focus on adaptability, confidence, and long-term growth.

As one CBA Live expert put it, “Retention is so important. A happy employee = a happy client.”

Supporting employee growth is key to retaining top talent, especially as frontline roles become more complex and cross-functional in a physical environment.

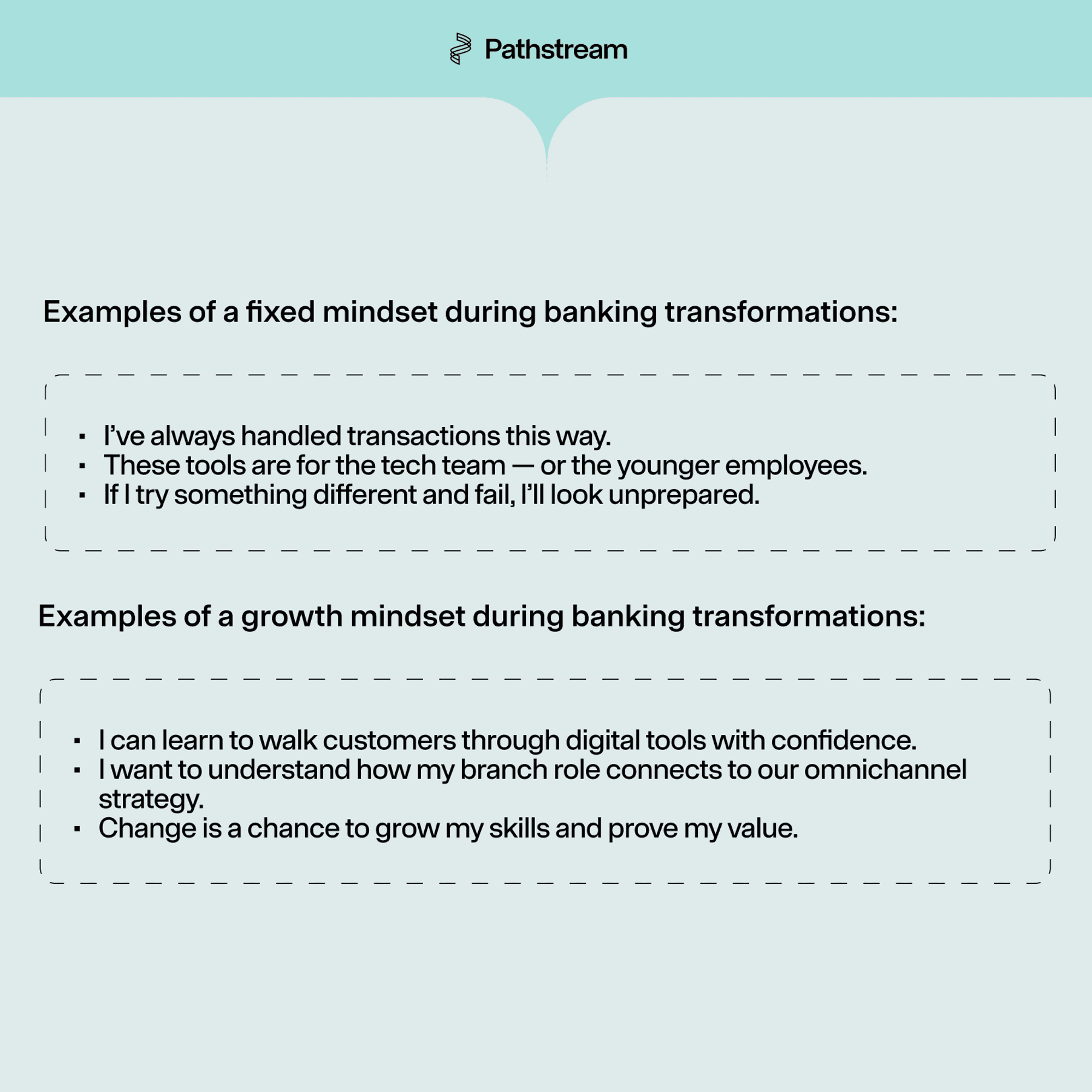

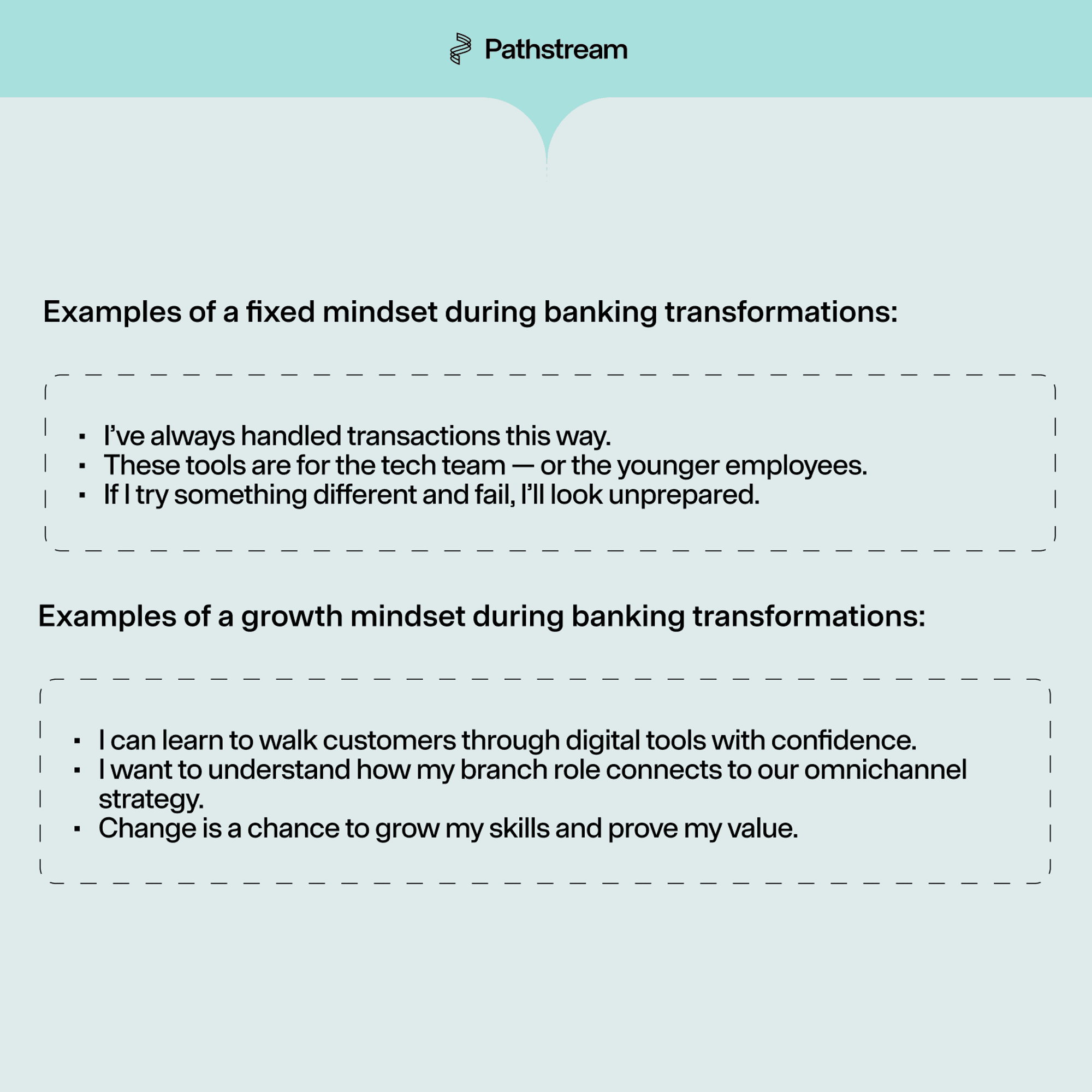

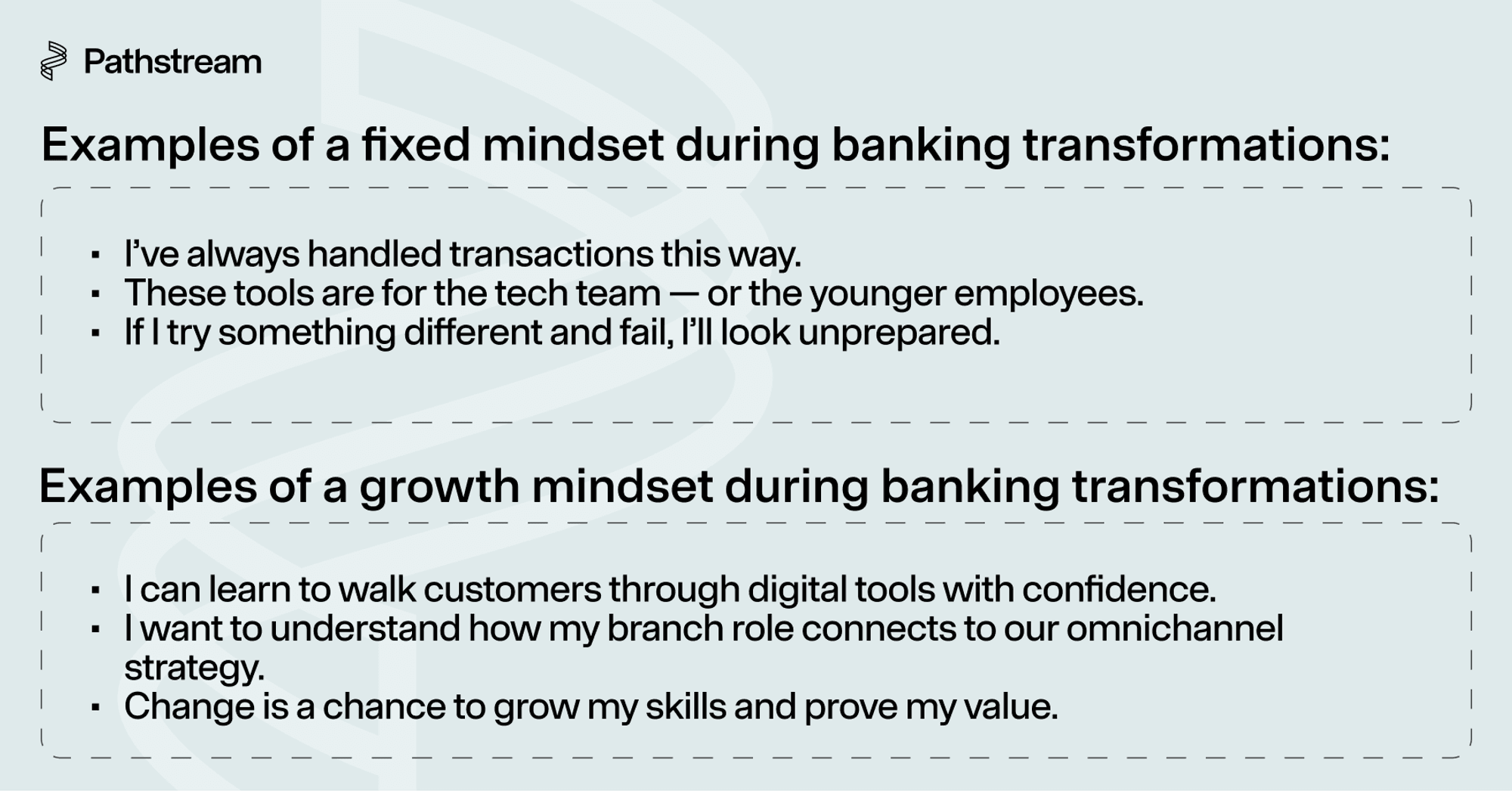

Mindset shifts matter — especially during times of change. Here’s how mindsets show up on the front line:

Phygital Banking Demands Hyperlocal, Human-Centered Execution

Phygital doesn’t mean “one-size-fits-all.” It raises the bar for local relevance. In rural markets or among younger, rewards-focused customers, authenticity and personalization matter more in banking than ever.

Our frontline associates rallied around local messaging because it felt like their voice, not corporate marketing,” shared one CBA Live presenter. The frontline understands the community, adapts faster than central teams, and drives loyalty through trust.

Empowering your frontline, explained the speaker, means giving them autonomy and support. It also means reducing noise, like by streamlining systems so they can spend less time on transactions and more time on relationships.

Career Visibility Keeps Top Banking Talent Engaged

More than 50% of our leadership roles are filled internally,” one leader said, “but teammates need to know what skills they’re building toward.” That insight gets to the heart of frontline retention: career visibility matters. Even when internal mobility is strong, employees need to understand how to grow and where they’re headed.

In a phygital environment, career visibility requires:

- Clear career pathways and current stretch opportunities

- Support to embrace evolving tools and responsibilities

Not everyone needs to become a digital expert. But they do need to be growth-ready, adaptable, and confident in their value.

Pathstream Prepares Frontline Banking Teams For What’s Next

Phygital banking is here to stay. But sustaining operational excellence depends on how well you support the people making it all work — your branch associates, universal bankers, and frontline leaders.

Pathstream delivers flexible, university-credentialed programs for organizations in highly regulated, customer-facing industries like banking. Let’s talk about how we can support your frontline evolution. Get in touch today >